Chapter 2

The Global Landscape of Infrastructure Risk

2.1 The Importance of Risk Estimation

Financial risk metrics clarify the economic case for investing in resilience.

Assessing disaster and climate risk in infrastructure enables governments and other infrastructure owners to identify and estimate the contingent liabilities they are responsible for in each sector and territory.

Infrastructure asset risk reflects the concatenation of geological and climate related hazards, the exposure of infrastructure assets, and their vulnerability or susceptibility to loss and damage. Hazard patterns are controlled by geographic features such as tectonic faults, cyclone tracks, and floodplains. Asset risk can be higher in countries that are subject to multiple hazard events of higher frequency and intensity than in others with benign hazard landscapes. Climate change and drivers such as environmental degradation and changes in land use modify hazards such as floods, landslides, cyclonic wind and storm surges, and droughts. Identifying and mapping of hazards at an appropriate scale including flood prone areas and those susceptible to earthquake- and rainfall-triggered landslides, tsunami inundation zones, high earthquake intensities, and others (USFS, 2023) is normally the first step towards estimating asset risk.

Risk is configured not only by hazard but also by the density of the exposed population and assets. Estimating infrastructure exposure requires identifying the location and assigning an appropriate economic value to each asset (USFS, 2023). High-income countries have an infrastructure density Public capital stock per capita that may be orders of magnitude greater than most low-income countries.

The value of infrastructure assets in a medium sized city in the USA, for example, may be greater than entire low-income countries in Sub-Saharan Africa (USFS, 2023). Vulnerability, on the other hand, is associated with the quality of infrastructure governance and the capacity to ensure that infrastructure assets are built to appropriate resilience standards. If standards are higher, risk may be lower even in countries with high levels of hazard exposure. Conversely, countries with weak infrastructure governance may have higher asset risk than those with stronger governance, even if hazard levels and the value of exposed assets are lower. Vulnerability functions are applied to each kind of exposed infrastructure asset and for hazards of different frequency and intensity to estimate probable levels of loss and damage. These functions are generated from the statistical analysis of loss values over a range of hazard severities, derived from field observations, analytical studies or expert judgement.

2.2 The Global Infrastructure Risk Model and Resilience Index (GIRI)

2.2.1 Probabilistic Risk Assessment

Traditionally based on the frequency and severity of historical events, earlier approaches to risk assessment failed to account for low-frequency yet intense hazard events and drivers such as climate change.

The insurance industry in 1990s adopted probabilistic risk modelling as the best approach to estimate the full spectrum of risk and generate financial risk metrics to calibrate insurance premiums and risk financing mechanisms such as catastrophe bonds. Probabilistic models simulate future disasters which could possibly occur based on scientific evidence, reproducing the physics of the phenomena, and recreating the intensity of a large number of synthetic hazard events. In doing so, they provide a more complete picture of risk than is possible using historical data alone. Insurance industry catastrophe models normally estimate risk for specific insurance markets or bundles of assets and are rarely available to governments or infrastructure investors. Opensource global risk assessments such as the Global Risk Model have partially addressed this gap (UNDRR, 2017). Open risk modelling platforms and initiatives such as the OASIS Loss Modelling Framework and the Global Risk Modelling Alliance (GRMA) have also emerged (Oasis Loss Modelling Framework Ltd., 2023; V20 Members, 2023).

Insurance industry catastrophe models normally estimate risk for specific insurance markets or bundles of assets and are rarely available to governments or infrastructure investors. Open-source global risk assessments such as the Global Risk Model have partially addressed this gap (UNDRR, 2017). Open risk modelling platforms and initiatives such as the OASIS Loss Modelling Framework and the Global Risk Modelling Alliance (GRMA) have also emerged (Oasis Loss Modelling Framework Ltd., 2023; V20 Members, 2023).

2.2.2 The Global Infrastructure Risk Model and Resilience Index (GIRI)

The Global Infrastructure Risk Model and Resilience Index (GIRI) is the first publicly available and fully probabilistic risk model to estimate risk for infrastructure assets with respect to most major geological and climate related hazards.

- Hazard input data was obtained by developing comprehensive sets of simulated events accounting for all the possible manifestations of each hazard and providing information about the geographical distribution of the hazard intensities and their frequency of occurrence.

- The intensities and frequency of the hydrometeorological hazards were modified to account for two future scenarios, reflecting a lower and upper bound of climate change

The methodology paper referenced in Annexure 1 explains how the lower and upper limits of climate change were calculated, with respect to Representative Concentration Pathways (RCP). . As such, climate change was integrated into the GIRI model from its conceptual design.

- The exposure database was assembled by geo localizing exposed assets and networks in each infrastructure sector from available public data sources. Public and private buildings were also included in addition to the infrastructure sectors listed in Figure 2.1

- Economic values were assigned to each exposed asset using a bottom-up procedure (Marulanda, 2023). The total value of the infrastructure assets in each country was then scaled to reflect the value of the capital stock relative to other countries.

- Vulnerability functions, relating the hazard intensities to expected asset losses in a continuous, qualitative, and probabilistic manner, for all hazards, were developed for

The methodology paper referenced in Annexure 1 explains how the lower and upper limits of climate change were calculated, with respect to Representative Concentration Pathways (RCP).. over 50 infrastructure archetypes. These archetypes, for example a power station or an airport, are assemblies of different infrastructure elements, each of which has a specific vulnerability signature.

- The associated damage and loss for each asset included in the exposure database was then calculated for each stochastic hazard event. The distribution of probable future losses was generated from the exceedance rates for each loss value and presented for each sector as a loss exceedance curve (LEC) and derived financial risk metrics such as the AAL. The AAL estimates the contingent liabilities for each infrastructure sector in each country or territory. It is a compact metric with a low sensitivity to uncertainty, corresponding to the expected or average loss that may be experienced in the long run rather than historical loss or losses that will be experienced every year. This is known as the pure risk premium in the insurance industry when normalized by the exposed values. The AAL for any given infrastructure sector and country measures the resources that governments would need to set aside each year to be able to cover asset loss and damage over a long term.

2.2.3 Scale and Application Index (GIRI)

GIRI’s purpose is to improve understanding and make the global landscape of infrastructure risk and resilience visible.

GIRI can assist in the identification of the contingent liabilities internalized in each infrastructure sector and the implications for social and economic development in a context of climate change. It can, thus, provide the basis for developing national resilience policies, strategies and plans, and resilience standards.

Models with a global level of observation and a national level of resolution are too coarse to quantify risk in specific infrastructure assets or in the design of new infrastructure projects. However, assessments can be developed for specific portfolios of infrastructure assets at the sub-national, urban, or local scales, with the same methodology using more detailed input data on hazard, exposure, and vulnerability (USFS, 2023).

2.2.4 GIRI’s Limitations

Gross Fixed Capital Formation

(GFCF)

GIRI’s quality will improve as new hazard and exposure data becomes available. As climate change models become more robust, downscaling to local levels becomes more advanced, and the attribution science progresses, more precise data on hydro-meteorological hazards will also become available. Vulnerability functions are also likely to improve over time as they are used and tested in different applications. Estimating asset risk is critical, given that service disruption and broader systemic impact are normally associated with asset loss and damage. While GIRI improves the understanding and estimation of global infrastructure asset risk and resilience, the costs of service disruption have not been measured and identified even though they are often greater than the cost of asset loss. Similarly, the model does not estimate the cost of the wider impact of asset loss and service disruption on productivity, employment, health, education, and poverty. Likewise, this iteration of the GIRI does not model other important hazards including heatwaves, wildfires, permafrost melting, sea-level rise, or risk to ecosystems, natural capital, agriculture, or food production. These may be addressed in future iterations.

2.3 Global Infrastructure Risk

Gross Domestic Product

(GDP)

Under the present climate, the value of the global AAL in the principal infrastructure sectors is $301 billion. When buildings There are strong arguments for and against including the building stock within an overall definition of infrastructure. It has been included in this analysis for three reasons. Firstly, risk in social infrastructure, such as health and education facilities are included within the building stock and therefore, needs to be estimated as with other infrastructure sectors. Secondly, in LMICs most of the building stock is uninsured. Given that governments then become the insurers of last resort, in principle, loss and damage to the building stock form part of the contingent liabilities that governments hold, with critical fiscal implications. Thirdly, Gross Fixed Capital Formation (GFCF), which is a core economic indicator against which the AAL can be compared, includes buildings as well as infrastructure sectors.. , including health and education infrastructure, are included, the total infrastructure AAL of $732 billion represents approximately 14 percent of the global 2021 -2022 GDP growth. This estimate is conservative given that it does not include losses in agriculture or natural capital, or some small-scale extensive risks.

As discussed in Chapter 1, LMICs have a widening infrastructure deficit, low capacities for public investment, and difficulties in mobilizing private capital. According to GIRI, such countries have accumulated higher asset risk compared to high-income countries. In other words, countries that cannot afford to lose their existing infrastructure have the highest risk.

Global Infrastructure Risk Model and Resilience Index

(GIRI)

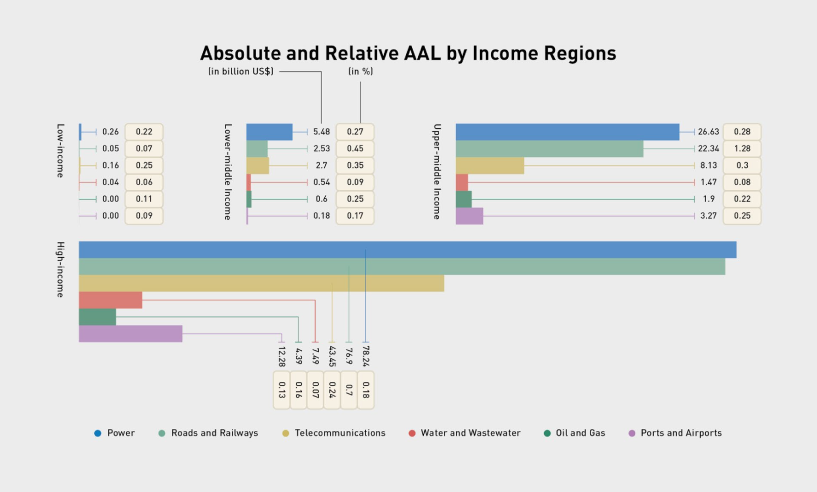

As Figure 2.4 shows, high-income countries concentrate 67.3 percent of the global exposed value of infrastructure assets. While LMICs account for only 32.7 percent of the exposed value, they account for 54 percent of the risk, with a total infrastructure AAL of $397 billion. While low-income countries account for only 0.6 percent of the exposed value, highlighting the infrastructure deficit in those countries, they hold 1.1 percent of the risk.

Low- and Middle-income

(LMIC)

The AAL in high-income countries represents only 0.14 percent of the exposed value. In contrast, this figure stands at 0.38 percent in low-income countries, 0.41 percent in lower-middle income, and 0.31 percent in upper middle-income countries. LMICs, therefore, have less infrastructure, lower investment, and higher risk compared to high-income countries.

Small Island Developing States

(SIDS)

A group of mainly LMICs (highlighted in purple), have high levels of both absolute and relative risk which means they will experience large-scale losses that would also be economically challenging.

Figure 2.6 complements these observations. Eighty nine percent of the exposed value is concentrated in North America, Europe and Central Asia, East Asia, and the Pacific, regional geographies that include most high income countries. Conversely, SubSaharan Africa accounts for only 1.4 percent of that value due to lower hazard exposure, but has a relative risk of 0.20 percent. Latin America and the Caribbean, and South Asia (with many LMICs), are the regions faced with the greatest resilience challenge. Loss and damage would annually account for 0.29 percent and 0.45 percent, respectively, of the exposed value.

Countries with high absolute but low relative risk experience losses that do not necessarily challenge their fiscal resilience. It is, however, severely challenged in countries with low absolute but very high relative risk. On the flipside, the investments required to strengthen resilience may be relatively small in these countries. Strengthening resilience in high-risk countries with small economies such as SIDS may not require globally significant investments but could make a critical difference to their sustainable social and economic development.

Infrastructure Sectors = Power; Roads and Railways; Ports and Airports; Water and Wastewater; Telecommunications; Oil and Gas. Total Infrastructure = Infrastructure Sectors plus buildings, including Health and Education infrastructure.

2.4 Geological and Climate-Related Risk and the Impact of Climate Change

Globally, 30 percent of the AAL is associated with geological hazards such as earthquakes, tsunamis, and earthquake-induced landslides and 70 percent with climatic hazards such as cyclonic wind, storm surge, flood, and rainfall-induced landslides. While climate change is an increasing threat, in many countries, geological risk cannot be ignored. Across all regions, the relative AAL associated with climate-related hazards is higher than that associated with geological hazards. The two regions with the highest climate related AAL are South Asia with 0.43 percent and Latin America and the Caribbean with 0.22 percent

Risk was modelled using two future climate scenarios for 2100, one based on a lower bound of climate change and the other on a more carbon-intensive pathway. At the lower bound, the global AAL for infrastructure sectors rose to $304 billion and to $329 billion at the upper bound, representing 0.16 to 0.18 percent of the exposed value. Taking into account climate change, the total infrastructure AAL, including buildings and the health and education sectors, would be in a range of $732 – $845 billion.

The stacked bars on the opposite edges of each page represent the proportion of Absolute AAL for geohazards (left) and climate-related hazards (right). Follow the lines emerging from these bars for additional data on Relative AAL for each geographic region, shown through circles.

Infrastructure Sectors = Power; Roads and Railways; Ports and Airports; Water and Wastewater; Telecommunications; Oil and Gas. Total Infrastructure = Infrastructure Sectors plus buildings, including Health and Education infrastructure.

Infrastructure Sectors = Power; Roads and Railways; Ports and Airports; Water and Wastewater; Telecommunications; Oil and Gas. Total Infrastructure = Infrastructure Sectors plus buildings, including Health and Education infrastructure.

Figure 2.14 Countries Expected to Face Decrease (Left) and Increase (Right) in AAL Source: Cardona et al. (2023a)

Figure 2.13 shows the impact of climate change by income geography. The total AAL may increase by 9 percent within high-income countries at the upper bound of climate change, 12 percent within lower-middle income countries, and 22 percent within upper-middle income countries. It may increase by 33 percent within low-income countries, implying that climate change will have a significantly greater impact in those countries with the largest infrastructure deficit, weak infrastructure governance, low fiscal capacity, and low levels of private investment.

Figure 2.14 depicts countries that would experience the greatest increase and decrease in their AAL due to climate change. Countries and territories in the Sahel, Middle East, the Horn of Africa, and several SIDS are all likely to see major increases in their risk. Chad, Cape Verde, Eritrea, and Iraq, for example, could see over 200 percent increase to their AAL by 2100.

In contrast, other countries, particularly in Europe, may see declines in their AAL where hotter and drier conditions reduce flood risk to infrastructure assets.

Box 2.1

Box 2.1

Hydrological Drought and Power Generation

Source: Camalleri et al. (2023)

Hydrological drought occurs when reduced rainfall leads to shortfalls of surface or ground water availability. It can stress the availability of water for domestic, industrial, agricultural, transport and power generation, disrupting essential services and generating major economic losses. As hydropower plants require a consistent supply of water to generate electricity, water stress may reduce output leading to power shortages and increased reliance on other energy sources such as fossil fuels.

Climate change may significantly modify the AAL of hydropower generation Countries where 75 percent of the total energy between 2011 and 2020 was generated by hydropower, with a total annual production greater than 0.5 TWh. The energy production data used in this study were obtained from the BP Statistical Review of World Energy and Ember.. in countries where it represents a primary source of energy under a lower and upper climate change scenario. Estimates indicate that AAL may increase dramatically under the upper climate change scenario in countries like Afghanistan, Lesotho, and Costa Rica. In Lesotho, for example, the relative AAL would increase from 12.8 to 34.8 percent of the annual hydropower production and 6.8 to 32.4 percent in Costa Rica. Paraguay, in contrast, would see a reduction from 4.0 to 1.5 percent and Norway from 1.7 to 0.4 percent

Nature-based Infrastructure Solutions

(NbIS)

Box 2.1 examines how increased water stress from climate change will modify hydropower generation in countries where this is a major source of energy

2.5 Risk in Infrastructure Sectors

Figure 2.15 shows how the exposed value and AAL are distributed across infrastructure sectors. Roads and railways, telecommunications, and power and energy account for around 80 percent of the total AAL of infrastructure sectors, so strengthening resilience in these sectors will generate an important dividend in most countries.

The following sections illustrate absolute and relative AALs for each sector. SIDS continue to have the highest relative risk and high-income countries the highest absolute risk across almost all sectors. However, countries with the highest absolute and relative risk vary considerably from sector to sector. Power in Bangladesh, roads in Peru and Ecuador, telecommunications in Hong

Kong and the Philippines, water and wastewater in Myanmar, oil and gas in the United Arab Emirates, and ports and airports in Hong Kong and Macau are all examples of country-specific resilience challenges.

Each hazard also has an impact on infrastructure sectors in different ways. Flood and wind are associated with around two-thirds of the power sector’s AAL. Wind is associated with about two-thirds of the telecommunications sector’s AAL, and over half the oil and gas and ports and airports’ AAL. In contrast, landslides and earthquakes are associated with over threequarters of the road and rail AAL and earthquakes with around two-thirds of the water and wastewater AAL.

Resilience challenges in each sector are associated with specific hazards that have different periods of recurrence. As Figure 2.16 highlights, earthquake risk in the case of Jamaica is associated with longer periods of recurrence compared to wind and flood. Countries, therefore, need to adopt hazard and sector specific resilience policies, tailored to maximize the resilience dividend.

2.5.1 Power

2.5.2 Roads and Railways

2.5.3 Telecommunications

2.5.4 Water and Wastewater

2.5.5 Oil and Gas

2.5.6 Ports and Airports

2.6 Social Infrastructure

The distribution of risk across different income and regional geographies is more skewed for social infrastructure compared to other sectors.

Health and education infrastructure in the form of schools, universities, hospitals, and care centres is a core pillar of a country’s social and economic development. If these assets are insufficient and lack resilience, asset loss and damage will be further aggravated by the social implications of interrupted education and healthcare. This can further exacerbate gender inequality as women are likely to have severely constrained access to social infrastructure, including that which enables access to the employment market and safe childbirth. For example, in South Korea, reliance on unpaid care labour of women poses a serious demographic and social sustainability challenge (Hong, 2019). Meanwhile, studies suggest that the impact of spending on social infrastructure in South Korea can result in a significant increase in the total non-agricultural output and employment in the short to medium term, and raises both male and female employment in the medium to long term due to increasing output (Oyvat & Onaran, 2022)..

As Figure 2.37 illustrates, relative risk in low-income countries across the education and health (0.41 percent) sectors is over three times greater than high-income countries (0.13 and 0.14 percent, respectively). These figures stand at 0.41 and 0.49 percent across low-middle income countries and 0.31 and 0.4 percent for upper-middle income countries, respectively. The lack of resilience in health and education infrastructure, therefore, presents a serious challenge for LMICs, to achieve the SDGs, particularly in South Asia where relative AAL for the education and health sectors stand at 0.51 and 0.47 percent, respectively, followed by Latin America and the Caribbean with 0.35 and 0.31 percent in education and health sectors, respectively.

Sustainable Development Goals

(SDG)

2.7 The Economic and Social Implications of Infrastructure Risk

The relative AAL reflects the proportion of a country’s capital stock at risk and provides an initial indicator of its economic implications. The higher the relative AAL, the greater the likelihood that resources for capital investment will have to be diverted to repairing and rehabilitating lost and damaged infrastructure. Similarly, the relative AAL is an indicator of low asset resilience, indicating a need to strengthen resilience standards.

Gross Fixed Capital Formation (GFCF) is a reasonable proxy value for capital investment in infrastructure and buildings. The higher the AAL/GFCF ratio, the lower will be the sustainability of future capital investment. High AAL/ GFCF ratios are, therefore, a major handicap in countries that need to attract significant new investment to reduce their infrastructure deficit. Figures 2.39 and 2.41, respectively, compare AAL with GFCF in each income and geographical region.

Countries with very high ratios of risk to capital investment include those struggling with conflict or post-conflict fragility such as Sudan, Haiti, Syria, Ukraine, several SIDS, and countries like Bangladesh, the Philippines, and Honduras that have high absolute and relative AAL.

The relationship between AAL and savings and reserves is also key. Countries with high levels of domestic savings may be able to cover for AAL

Figure 2.41 shows that each region faces different challenges with respect to their GFCF, gross savings, reserves, and social expenditure. In Latin America and the Caribbean, for example, the AAL represents a very significant proportion of GFCF, savings, and reserves. In South Asia it represents a very high proportion of social expenditure.

Gross Fixed Capital Formation

(GFCF)

In countries with low levels of capital investment, even low to medium levels of risk can threaten development. In Greece, for example, the AAL /GFCF ratio is 32 percent, implying that the recovery of infrastructure assets may take years if a significant proportion of the capital stock is damaged. The size and diversity of a country’s economy is also an important factor. Greater economic complexity and diversity offers a means for redundancy and flexibility useful at the time of shocks to some sectors. Figure 2.40 compares the economic diversity of some countries, where economies such as China, Mexico, and India are seen to be much more diverse as compared to smaller economies such as Papua New Guinea,

Mali, and Peru. Countries with small and vulnerable economies, especially the SIDS, face far greater challenges to cover their AALs than large and diversified economies (Fig. 2.41).

As Figure 2.42 highlights, the development implications across LMICs are generally greater than in high-income countries. Low-income countries face particularly extreme challenges as the AAL represents a high proportion of GFCF, savings, reserves, and social expenditure. The AAL represents almost a fifth of social expenditure across low-income countries and more than 12 percent in lower middle-income countries. Constrained social budgets may be further reduced, given the need to cover for asset loss and damage, generating a downward spiral of reduced investment and increasingly precarious social services. The AAL also represents more than 15 percent of the reserves of lowincome countries, compromising fiscal resilience.

2.8 Using Financial Risk Metrics to Estimate the Resilience Dividend

Financial risk metrics make the economic case for resilience as they enable governments to understand their contingent liabilities and identify sectors or territories of concern. Understanding contingent liability is an essential step towards measuring the fiscal risk internalized in infrastructure systems, generating a political and economic incentive for strengthening resilience and reducing uncertainty for potential investors. In Barbados, for example, the GIRI highlights that contingent liabilities from all hazards represent around 34 percent of the country’s GFCF. Unless resilience is strengthened, as stated in Chapter 1, new infrastructure investment would be analogous to pouring water into a bamboo basket.

Risk identification can also guide land use planning, determining hazard exposed areas, where either no new infrastructure should be located, or where the costs of ensuring adequate asset resilience would be too high to justify the services provided by the infrastructure. By estimating the costs of achieving different levels of resilience, and the benefits associated with the resilience dividend, risk estimation can stimulate a transparent debate on the level of resilience that is most cost-effective and feasible.

The GIRI, when replicated at a higher resolution, can be used to test different strategies to strengthen resilience. Any strategy has the possibility to increase or decrease the AAL with a given level of capital and operating expenditure. This can help estimate the value of the full range of other resilience benefits, for example, improvements in water supply or quality, enhanced local economic development and others, and aid in the selection of an appropriate strategy.

In the case of Colombia, Boxes 2.2 and 2.3 illustrate how financial risk metrics were used to assist governments in understanding their contingent liabilities, estimate the resilience dividend, and select the most appropriate strategies.

Financial risk metrics were used to quantify the resilience dividend accruing not only from reduced asset loss and damage but also reduced service disruptions. Box 2.4 examines the resilience dividend that could be captured by strengthening the resilience of East Africa’s roads and railways.

Box 2.2

Box 2.2

E2050 Strategy Colombia – Adaptation Measures for a More Resilient Main Road Network Source: Cardona et al., (2020); Eslamian & Eslamian, (2022)

Colombia’s E2050 Strategy aims to establish a carbon-neutral and climate resilient economy. Guided by principles of mitigation, adaptation, and climate risk, the national policy prioritizes meeting goals for 2022, 2030, and SDG compliance. Efficient measures within limited resources are sought to achieve these objectives, considering risk reduction and implementation costs. Assessing the impact of climate change is crucial, starting with identifying risk in various territories and sectors. As part of E2050, a probabilistic analysis evaluated landslide disaster risk on the main road network, including risk exacerbated by climate change (Table 2.1).

The upper and lower climate bounds are associated with scenarios of GHG emissions by 2050. The upper bound represents a high emissions scenario, under which far less rainfall is expected. As such, the risk associated with rainfall-triggered landslides will also be lower, exemplifying what is sometimes a non-linear relationship between emissions and risk.

The Risk Control Engineering methodology identifies adaptation strategies for mitigating landslide risk in the main road network. As Figure 2.43 illustrates, these strategies are implemented gradually with intervention levels established to assess their effectiveness in reducing risk, measured by the AAL. Interventions can vary from small-scale to larger and costlier approaches. Evaluating the costs of each strategy helps determine the practical limit of adaptation where further investments yield diminishing risk reductions. Reaching the maximum feasible adaptation level makes the impact of climate change less visible. The remaining loss represents residual risk that cannot be mitigated by the considered measures.

In general, it is not possible to affirm that one measure is more appropriate than another without incorporating the context, technical and political feasibility, and institutional execution capacity, among other factors. The costs of implementing different adaptation measures are average yet indicative estimates of the real values that are used to establish an order of magnitude of the investment required in adaptation.

Box 2.3

Box 2.3

Ecosystem-Based Adaptation and Flood Risk Reduction in La Mojana Region: Recommendations Based on Probabilistic and Holistic Risk Assessment Source: Cardona et al., (2017); CONPES, (2022)

The region faces increasing risk due to the construction of inappropriate drainage and protective infrastructure that provides the population with a false sense of security. Physical risks associated with flood hazard in La Mojana was estimated using a probabilistic methodology. Developed by INGENIAR for the Colombian Adaptation Fund (Fondo Adaptación). Similarly, the costs and benefits of a range of strategies were assessed to reduce the risk, ranging from no intervention at all (No. 1), reinforcing the existing dyke (No. 2), reinforcing and extending other dykes (No. 3), reinforcing the existing dyke but with bypass structures that allowed water to flow from one water body to another (No. 4), and constructing a parallel dyke with floodgates (No. 5).

Figure 2.45 shows the cost of each strategy and how they would modify the AAL. No. 2 was the most expensive strategy with the highest resulting AAL while strategies 3, 4, or 5 did not offer any significant advantages.

Strategies were also examined to reduce exposure and vulnerability by (1) constructing protective walls around the towns, building health centres, and schools, and promoting productive and environmental projects, and (2) raising rural houses on stilts and improving natural drainage channels. Each intervention had a different cost and considered different sets of municipalities and adaptation combinations.

These strategies were compared with respect to their benefit/cost ratios with 10 of the best and most effective selected and compared in terms of risk, social, and ecosystem benefits, and the net resilience dividend with the full community’s involvement. Ultimately, a series of non-structural measures, including NbIS, were chosen to address the underlying drivers of vulnerability and risk with a total investment of $580 million.

Box 2.4

Box 2.4

Flood Risks and Adaptation of Long-Distance Transport Links in East Africa Source: Pant, Jaramillo & Hall (2023), Hickford et al. (2023)

Long-distance road and rail networks across Kenya, Tanzania, Uganda, and Zambia are vital for underpinning trade flows that sustain economic growth. Major transport infrastructure investments in recent years have reinforced the role of these countries as gateways to growing domestic markets in Africa (Horvat et al., 2020).

However, extreme floods repeatedly cause infrastructure damage and disruption. About three-quarters of all counties in Kenya experienced flooding in 2020 (Makena et al., 2021) whereas climate hazards in Tanzania have cost the country about one percent of their GDP (Erman et al., 2019). Rising water levels of Lake Victoria in Uganda have destroyed roads and flooded homes and businesses (Brown, 2020), while flooding in Zambia in 2023 disrupted transport access for several communities (Davies, 2023).

Social and economic development in East Africa is contingent on resilient long distance transport networks. It is vital, therefore, to estimate climate risk and propose resilience outcomes. A recent study estimated extreme riverine flood risks and climate adaptation options spatially across long-distance road and rail links across the four countries, looking at the exposure of rail and road networks to flooding in the present with futuristic projections; the extent of direct physical flood induced damage to the transport network; losses and the wider economic impact of infrastructure failures; identifying quantifiable climate resilience adaptation options for infrastructure assets; and proposing priority network locations for intervention (Hickford et al., 2023).

According to the study, asset risk for road and rail assets in the four countries would grow from an AAL of $41 million per year to about $82 to $131 million per year by 2080 with climate change due to an increasing frequency of more extreme floods. Further, road and railway assets designed for historical flooding would not be resilient to future extremes, increasing indirect risk to trade flows due to disruptions of key transport linkages from $0.16 million to about $4.2 million per day by 2080.

The study put forward a compelling case for investing in strengthening asset resilience, showing that the benefits far outweighed investments required until 2080. Strengthening resilience of the 20 roads and railway lines in the region with the highest flood risk would cost $9 million and $92 million, respectively, but would avoid losses as high as $875 million and $234 million across future climate scenarios. The outputs of the study have been made available through an open-access web-portal accessible at: https://east-africa. infrastructureresilience.org/. Results of this study are being used to inform stakeholders in Kenya about the risks to new road highway projects being planned in the country.

The visual in Figure 2.46 shows growing risks from the baseline (2010) to the future (2080) to direct damages and indirect economic losses for a road link exposed to river flooding modelled under future RCP 4.5 and RCP 8.5 climate scenarios.