Chapter 1

The Resilience Challenge

1.1 Infrastructure for Sustainable Development

Infrastructure is the engine of economic growth and social development.

%

In 1970, French sociologist and philosopher Henri Lefebvre put forward a hypothesis: the total urbanization of society (Lefebvre, 1970). Fifty years later, his hypothesis has been largely fulfilled. Whether examined through a territorial, economic, social, cultural, or political lens, society has become essentially urbanized (UNDESA, 2019). Contemporary urban lifestyles and their associated patterns of production, distribution, and consumption now predominate in all regional and income geographies, shaping and moulding a global demand for land, water, food, energy, and other resources. The rural–urban dichotomy has gradually lost much of its interpretative value in analyzing development challenges and problems through a constantly expanding and increasingly tight web of relationships between cities, peri-urban areas, and villages.

Ongoing urbanization across Africa serves as a striking example of Lefebvre’s vision. In 1950, only 13 percent of the continent’s population lived in cities, but this had risen to almost 27 percent by 1980 and nearly 50 percent by 2015. The total number of towns and cities across Africa more than doubled from 3,319 in 1990 to 7,721 in 2015 too. Approximately 50 percent of rural Africans today live within 14 kilometres of a city (Kisumu, 2023).

Massive and ongoing investments in infrastructure across all sectors and territories has facilitated urbanization. Gross Fixed Capital Formation (GFCF ), has steadily increased since 1970 from just over $742 billion to more than $25 trillion today (Figure 1.1). In other words, more than 90 percent of infrastructure around the world has been built in the last 50 years alone.

Gross Fixed Capital Formation

(GFCF)

Figure A.1 Proportion of Countries or Areas with Available Data Since 2015, by SDGs Source: UN (2022)

Box 1.1

Box 1.1

Infrastructure Definitions and Classification

Infrastructure has Latin origins, meaning “underneath or below the structure.” It was first used in France during the late 1800s to refer to the substructure or foundation of a building, road, or railroad bed and did not become a part of English vocabulary until after World War II. CDRI defines infrastructure as “individual assets, networks, and systems that provide specific services to support the functioning of a community or society” (CDRI, 2023). This is similar to the definition of infrastructure adopted by the United Nations, as “the physical structures, facilities, networks and other assets which provide services that are essential to the social and economic functioning of a community or society” (UNDRR, 2017). Based on their scale, purpose, and topology, infrastructure systems can also be grouped into two broad categories; strategic economic (or critical) infrastructure refers to infrastructure that supports strategic sectors, regional and global trade, and economic integration, including power stations, ports and airports, large dams, refineries, logistic hubs and major highways, railways, and hightension transmission lines; local (or basic) infrastructure systems refer to infrastructure that provide essential services to individuals, households, communities, and businesses In the context of local infrastructure systems, the term ‘business’ is used to refer to the small and medium enterprises that provide most employment in regional economies and their urban centers.. , including water, drainage, sanitation networks, local roads, rivers, rail networks, health and education facilities, and post-harvest processing and storage facilities, among others. Local infrastructure systems nest within national, regional, and global networks of strategic economic infrastructure in topological terms.

The 2030 Agenda for Sustainable Development, endorsed by 193 countries and all G20 nations, recognized the fundamental role of infrastructure (Thacker et al., 2019). Infrastructure is not only critical to the achievement of SDG 9 (industry, innovation, and infrastructure) but also to SDG 3 (good health and well-being), SDG 4 (quality education), SDG 6 (clean water and sanitation), SDG 7 (affordable clean energy) and SDG 11 (cities’ resilience to disasters) (UN, 2015). Besides, dependable essential services are closely linked to multiple welfare benefits such as sustained employment (SDG 8), poverty reduction (SDG 1) and gender equality (SDG 5).

Reducing constraints on access to employment and risk of violence also helps facilitate greater independence and opportunity for women. Economic growth and social mobility are highly dependent on investment in inclusive and gender-responsive infrastructure even though they are mostly designed by men. Therefore, the role of women in the design and provision of infrastructure and their perspectives in building infrastructure resilience is critical. This is clearly illustrated in Colombia and India.

The Colombian Presidential Council for Gender Equality (CPEM), the National Planning Department (DNP), and the Ministry of Finance adopted a methodology in 2019 to identify, track, and monitor public investments that had a gender equality component (Trazadores Presupuestales para la Equidad de la Mujer). Their methodology also included tools for public practitioners to mainstream gender considerations throughout the investment lifecycle, particularly strategic planning.

While the Planning Commission in India ensures that national and state plans are gender-sensitive, the Department of Commerce identifies gender implications of special economic zones, and the Ministry of Urban Development introduced measures for clean and safe public toilets and adequate street lighting (OECD, 2021). It has been estimated that the application of a gender lens to infrastructure development alone would increase the total GDP of the OECD’s member states by 2.5 percent until 2050 (UNEP et al., n.d.).

Gross Domestic Product

(GDP)

The growth of a country’s infrastructure stock is closely correlated to other economic variables such as Gross Domestic Product (GDP) and labour productivity (Figure 1.2) .

Figure 1.2 Growth Rates in Capital Stock and Productivity Across Economies (1960-2019) Source: IMF (2019)

Investing in local infrastructure systems is also critical to social development and achieving the SDGs. For example, safe, reliable, and affordable rural transport would ensure that agricultural communities have access to markets, health and education facilities, employment opportunities, and are able to develop modern supply chains to prevent food loss and secure reliable income flows (Cook et al., 2017). Social infrastructure such as health centres, clinics, and schools would ensure that essential services are accessible to all (Cook et al., 2017). Seen from the perspective of the 2030 Agenda for Sustainable Development, local infrastructure systems would be better considered as the first mile rather than the last mile of development.

Sustainable Development Goals

(SDG)

Conversely, development in many LMICs and low-income countries is constrained by large deficits of strategic economic and local infrastructure systems. In these countries, weak infrastructure governance leads to precarious, low quality, infrastructure assets that undermine the provision of dependable essential services.

Low- and Middle-income

(LMIC)

Furthermore, in regions exposed to physical hazards, such as floods, earthquakes or tropical cyclones, infrastructure often internalizes high and growing levels of disaster risk. Disaster damage leads to increasing damage to infrastructure assets and aggravated service disruption. Capital investment budgets then have to be reorientated to repair, rehabilitate, and rebuild damaged infrastructure. Much “new” public infrastructure investment is, in reality, used to patch up post-disaster damage.

Taking climate change into account, the global Average Annual Loss (AAL) for infrastructure, including buildings, currently lies between $732 – $845 billion, representing about 14 percent of 2021-2022 global GDP growth. LMICs hold roughly half of this contingent liability.

Average Annual Loss

(AAL)

For example, power generation may be insufficient to meet additional cooling needs required to cope with urban heat waves, leading to increased heat related morbidity. Storm drainage may be unable to cope with extreme rainfall, leading to increased urban flooding. Agriculture may become unviable in areas experiencing hotter and drier conditions, forcing migration to cities, and putting further strain on urban infrastructure. Worryingly, the impact of such events is likely to disproportionately impact women, older populations, and children, and/or those with informal employment, increasing existing inequities in the process.

The growth of urban civilizations over several millennia has been enabled by infrastructure such as defensive city walls and forts that were later abandoned or demolished while infrastructure such as modern power and transport networks were introduced, ushering in new patterns and modes of urbanization. Radical changes are taking place today in the way infrastructure systems are developed and used as the transition to carbon-neutral and carbon-negative development gains pace in sectors such as energy and transport. As pipelines and refineries are replaced by wind and solar farms and new transmission lines and petrol stations are replaced with vehicle charging points, many infrastructure assets in these sectors will become stranded, stressing economies in LMICs that fall behind in the transition.

To summarize, many LMICs now face a multidimensional challenge. A large infrastructure deficit which constrains social and economic development; precarious and poorquality infrastructure due to deficiencies in infrastructure governance; rising asset loss and damage, associated with disaster risk, leading to more frequent service disruption; and a stock of existing infrastructure increasingly ill-suited to address the challenges posed by climate change and rapid technological change.

All new infrastructure investment has the potential to either undermine or reinforce resilience. However, most of the new infrastructure required is yet to be built, so decisions taken now could lock countries in a development trajectory that may or may not be sustainable and resilient (Pols & Romijn, 2017; Seto et al., 2016).It is unquestionable that massive new infrastructure investment is required to accelerate development. But large volumes of investment will not be effective in supporting social and economic development unless the infrastructure is resilient.

1.2. Dimensions of Infrastructure Resilience

Resilience derives from the present participle of the Latin verb resilire, meaning “to jump back” or “to recoil”. In recent years, resilience has become something of a cliché in development circles. The more the term is used, the less precise its definition becomes.

Resilience derives from the present participle of the Latin verb resilire, meaning “to jump back” or “to recoil”. In recent years, resilience has become something of a cliché in development circles. The more the term is used, the less precise its definition becomes. Box 1.2 presents the definitions of resilience used in this report.

Conventionally, infrastructure resilience has been considered to be primarily an engineering issue: strengthening the capacity of infrastructure assets and services to resist and absorb the impact of extreme geological or climatic hazards, considered as external or exogenous threats to infrastructure systems (Rogers et al., 2012). According to this perspective, improved design standards and norms, new materials, technologies, and enhanced system management and operations all help enhance resilience.

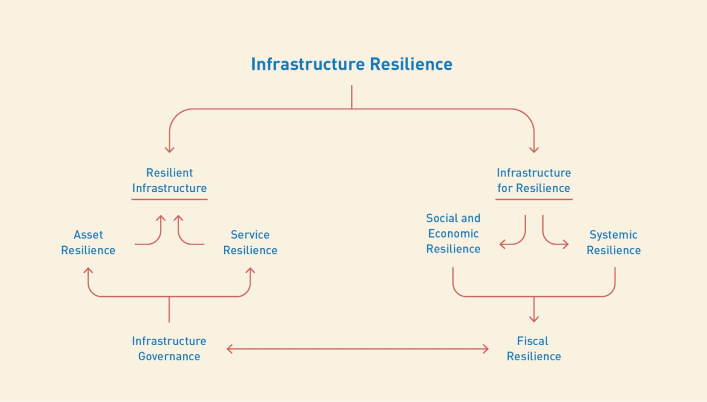

This interpretation, however, only captures some dimensions of the issue. Infrastructure resilience can be conceptualized as resilient infrastructure but also as infrastructure for resilience. In the first case, resilient infrastructure refers to infrastructure that can absorb, respond to, and recover from hazard events and shocks.

Infrastructure for resilience refers to infrastructure that supports broader social and economic or systemic resilience without generating or accumulating new systemic risk. Climate change, biodiversity loss, growing social and economic inequality, and unplanned urban development are ultimately endogenous attributes of the urbanization process and of the way infrastructure has been developed (Lavell & Maskrey, 2014; Maskrey et al., 2023). As such, infrastructure investments over the last 60 years have themselves been a major driver of systemic risk.

presents the definitions of resilience used in this report.

Conventionally, infrastructure resilience has been considered to be primarily an engineering issue: strengthening the capacity of infrastructure assets and services to resist and absorb the impact of extreme geological or climatic hazards, considered as external or exogenous threats to infrastructure systems (Rogers et al., 2012). According to this perspective, improved design standards and norms, new materials, technologies, and enhanced system management and operations all help enhance resilience.

This interpretation, however, only captures some dimensions of the issue. Infrastructure resilience can be conceptualized as resilient infrastructure but also as infrastructure for resilience. In the first case, resilient infrastructure refers to infrastructure that can absorb, respond to, and recover from hazard events and shocks.

Infrastructure for resilience refers to infrastructure that supports broader social and economic or systemic resilience without generating or accumulating new systemic risk. Climate change, biodiversity loss, growing social and economic inequality, and unplanned urban development are ultimately endogenous attributes of the urbanization process and of the way infrastructure has been developed (Lavell & Maskrey, 2014; Maskrey et al., 2023). As such, infrastructure investments over the last 60 years have themselves been a major driver of systemic risk.

Box 1.2

Box 1.2

Resilience Source: CDRI (2023)

Resilience is defined by the United Nations Chief Executive Board (CEB) as “the ability of individuals, households, communities, cities, institutions, systems and society to prevent, resist, absorb, adapt, respond and recover positively, efficiently and effectively when faced with a wide range of risks, while maintaining an acceptable level of functioning and without compromising long term prospects for sustainable development, peace and security, human rights and well-being for all” (United Nations, 2020). For its part, CDRI defines disaster resilient infrastructure as “infrastructure systems and networks, the components, and assets thereof, and the services they provide, that are able to resist and absorb disaster impacts, maintain adequate levels of service continuity during crises, and swiftly recover in such a manner that future risks are reduced or prevented”.

Infrastructure resilience is conditioned by core enablers such as infrastructure governance and financing. Figure 1.3 shows the concatenation of the different dimensions of infrastructure resilience.

Despite the close links between disaster resilience and resilience to climate change, they are different. Around 33 percent of the disaster risk internalized in infrastructure and buildings is associated with geological hazards such as earthquakes or tsunamis that are not climate conditioned. Similarly, many infrastructure assets are not resilient to hazards such as floods or tropical cyclones under existing climate conditions. However, as discussed above, climate change will increase disaster risk challenging the resilience of infrastructure assets and essential services. Climate change is expected to increase risk in infrastructure sectors between 5 and 14 percent and total infrastructure risk between 11 and 21 percent.

Climate change simultaneously affects the capacity of infrastructure to provide essential services even when assets remain intact during disasters. Existing infrastructure, for example, may no longer be functional in a changing climate or may experience premature obsolescence due to technological change. To illustrate, increased hydrological drought reduces the capacity of hydroelectric power plants to generate energy while water levels in major river systems may be too low to support barge traffic even though no infrastructure assets are damaged.

1.3. Social and Economic Resilience

The gap in infrastructure investment between lower and higher income countries is widening, constraining social and economic development in the former while increasing global inequities.

Access to services provided by infrastructure strengthens social and economic resilience. Before the Industrial Revolution, for example, climate variability led to frequent famines across rural areas in France due to stressed or collapse of local food production systems (Le Roy Ladurie, 1993). They became increasingly rare as new transport infrastructure connected rural areas to national, regional, and global food markets during the 19th century.

While access to essential services is largely taken for granted in highincome countries, in many LMICs, in particular in low-income countries, service provision is still constrained by a large infrastructure deficit. Inexistent or unreliable essential services undermine broad social and economic resilience. This infrastructure deficit is especially critical for women and girls. Women and girls across the world spend over 200 million hours every day collecting water (i.e., an equivalent of 8.3-million-person days or 22,800 person years) (UNICEF, 2016), increasing their exposure to physical and sexual violence. Roughly 40 billion hours per year are spent to collect water – equivalent to a whole year of labour by France’s entire workforce – in Sub-Saharan Africa alone. Similarly, around 66 percent of households in Sub-Saharan Africa, 55 percent in South and South-east Asia, and 31 percent in Latin America still rely on firewood for cooking (FAO, 2018).

While the real value of the global public capital stock per capita has nearly tripled since 1960, its distribution is highly unequal, closely mirroring the global distribution of GDP per capita (Figure 1.4). Currently, the per capita value in high-income countries is $200,000 compared to $37,000 in upper-middle-income countries, $8,000 in LMICs, and $3,000 in low-income countries. In Switzerland, for example, the per capita value of infrastructure assets is over $375,000 while it is only $4,600 in Senegal, a low-income country (Cardona et al, 2023a). Such a difference in value is conditioned by factors such as the value of infrastructure, population, and territorial size.

A lack of infrastructure has drastic implications for social and economic well-being. As of 2020, roughly 300 million people in the Asia-Pacific region have no access to safely managed or basic water services such as drinking water. Further, 1.2 billion lacked adequate sanitation (ADB, 2020).

Box 1.3

Box 1.3

Progress Towards SDG 6 in 2022 Source: UN (2022)

Goal 6: WATER

Universal access to drinking water, sanitation, and hygiene is critical to global health. Managing to reach universal coverage by 2030, would save 829,000 lives each year only by increasing our current rate of progress by four times. Over 800,000 people die each year from diseases directly attributable to unsafe water, inadequate sanitation, and poor hygiene practices. Worryingly, 2 billion people as of this moment lack access to such services, basic or otherwise. Eight out of 10 people who lack even basic drinking water live in rural areas around the world with roughly half of them living in least developed countries (LDCs). At the current rate of progress, the world would leave 1.6 billion people without safely managed drinking water supplies and 2.8 million people without access to safely managed sanitation services of which a disproportionate burden is likely to fall on women and girls.

There are similar variations in the quantity and quality of infrastructure within LMICs, reflecting unequal territorial distribution and development. For example, access to essential services in some regencies in Jawa Barat and Gorontolo provinces is less than 50 percent even in an upper middle-income country like Indonesia (Figure 1.5).

Public and private capital investment in low-income countries as a proportion of GDP has consistently lagged behind middle or higher-income countries. For example, annual capital investment in Africa has historically averaged around 13 – 14 percent of GDP. In Asia, it averages 26 – 31 percent of GDP, nearly double that rate. As a consequence, the gap in infrastructure investment between lower and higher income countries is actually widening, constraining social and economic development in the former while increasing global inequities.

Source: UNDP (2021)

Furthermore, most public and private infrastructure investment flows into strategic economic infrastructure such as major transportation, energy production, and distribution (Bond et al., 2012). Conversely, local infrastructure systems receive far less, impeding local economic development, exacerbating poverty, and undermining progress towards the SDGs. It is worth noting that private investment in SDG-relevant infrastructure marked a decrease during and after the COVID-19 pandemic (Figure 1.6). Since the pandemic, progress against some SDGs such as clean water and sanitation seems to have stalled and reversed in some countries. Populations without electricity throughout Sub-Saharan Africa, for example, rose from 74 percent before the pandemic to 77 percent (IEA, 2022).

Source: UNCTAD (2023)

1.4. Infrastructure Governance

Deficient planning and design, inadequate standards, ineffective systems for regulation and compliance and low levels of investment in maintenance and operation characterize weak infrastructure governance, all of which aggravate the infrastructure deficit across LMICs

In contrast, weak infrastructure governance is a barrier to resilience, eroding economic growth, competitiveness, and social development (World Bank, 2020). The design standards adopted in infrastructure projects may not be appropriate to cope with increased risk due to climate change, environmental degradation, overutilization, unplanned urban development, and other drivers This locks risk into infrastructure systems as many assets are designed to last decades or more (Seto et al., 2016). Bridges and sewerage systems, for example, often have design lifespans of up to 100 years (Wright et al., 2018). Unfortunately, a lack of supervision, low compliance with standards, and corruption distort and degrade what may have been resilient designs. Designs, therefore, may not necessarily be reflected in what is built or sustainable over time.

Operations and maintenance O&M expenditures are often insufficient, leading to poor quality infrastructure and services, premature obsolescence, and the need to divert capital expenditure towards rehabilitation and reconstruction (UNESCAP, 2018). Capital investment in an infrastructure asset may only account for 15 to 30 percent of overall expenditure over its design lifecycle, while 70 to 85 percent of the expenditure is attributable to operations and maintenance (UN, 2021). Patching up assets with provisional repairs contributes to further service interruptions, reducing resilience in the process.

Operations and Maintenance

(O&M)

Weak infrastructure governance also means that increases in spending do not automatically result in improved quality of infrastructure or better outcomes. In France or the Netherlands, for example, infrastructure outcomes such as employment and economic growth increased between 2010 and 2015 despite reduced investment. Contrastingly, increased investments in countries such as Indonesia, South Africa, or Nigeria have not led to better outcomes (Hertie School of Governance, 2016).

Governance standards are clearly correlated with the quality of infrastructure. The higher the level of corruption in a country, the lower the overall quality of infrastructure (Hallegatte et al., 2019).

It is paramount for all these stakeholders across the whole infrastructure lifecycle to be involved and aligned if infrastructure governance is to enable strengthened resilience

Weak infrastructure governance undermines the capacity of LMICs to formulate and finance infrastructure projects. Its consequences are particularly felt in peri-urban areas and small and intermediate urban centres. Poor quality infrastructure and unreliable service delivery in informal settlements, for example, contribute towards inequality and multidimensional poverty (Pandey et al., 2022; Zhou et al., 2022). Rapidly developing second- and third-tier cities rarely have sufficient capacity to plan and manage infrastructure development, the provision of essential services, or land use (World Bank, 2016). This can further exacerbate gender inequality by, for example, limiting women’s and girls’ mobility and access to basic services (Morgan et al., 2020). In summary, weak or non-existent local planning conspires against infrastructure resilience, communities that depend on local infrastructure, and the most vulnerable.

It is also an obstacle to planning and managing a transition to carbon-neutral or -negative infrastructure systems. Entrenched bureaucracies with low awareness of and exposure to new technologies and with weak capacities to manage structural change are poorly placed to formulate the policies, strategies, plans, and projects needed to support such a transition or to attract requisite finance.

1.5. Asset Resilience

High levels of disaster-related asset loss and damage erode the capacity to make new capital investments as budgets are diverted to repair, rehabilitate, and reconstruct damaged infrastructure and to sustain budgets for operations and maintenance.

A specific attribute of weak infrastructure governance is that disaster and climate risks are rarely considered systematically in the conceptualization, planning, design, regulation, and management of infrastructure (ADB, 2019). Consequently, many infrastructure assets in hazard-exposed areas internalize high levels of disaster and climate risk, leading to asset loss and damage and service disruption.

As mentioned above, the total global infrastructure AAL including buildings lies within $732 and $845 billion. LMICs account for only 32.7 percent of the exposed value but 54 percent of the risk with a total infrastructure AAL of $397 billion. Similarly, low-income countries account for only 0.6 percent of the exposed value but 1.1 percent of the risk. Given very low levels of investment in low-income countries, high levels of asset risk further deepen and widen infrastructure deficits.

Ensuring that all new infrastructure investment is resilient, such that assets can absorb, and resist hazard impacts is, therefore, essential, if infrastructure is to be a motor for social and economic development, rather than a source of increasing contingent liability and future disaster. Unless asset resilience is strengthened, the massive new investments required to reduce the infrastructure deficit will contribute to the generation of new and unsustainable contingent liabilities for governments.

Market forces combined with weak planning and regulation lead to continued infrastructure investments in hazardprone areas, increasing exposure without the necessary measures to reduce vulnerability and strengthen resilience. Poverty drives low-income households to occupy areas exposed to floods and other hazards. Many informal settlements do not have risk-reducing infrastructure such as drainage that further magnify hazard. Environmental degradation increases hazards such as flood or drought through the loss of regulatory ecosystem services such as mangroves, wetlands, and forests, further undermining asset resilience. Climate change magnifies the severity and alters the frequency and predictability of many weather-related hazards such as storms, floods, and drought. In other words, assets that were once resilient are no longer able to resist extreme hazard events.

Asset resilience is associated with the adoption and implementation of Confidential: Do no circulate 42 appropriate design standards that consider risk levels. Such standards may not exist in many LMICs or are not translated into practice. While national governments are responsible for standard setting and developing normative frameworks, implementing those norms and standards may often fall to local governments that may not have the necessary technical capacity or resources while public works contracts may be characterized by weak supervision and compliance and undermined by corruption. Resilience standards may furthermore be deliberately lowered during construction to compensate for reduced project budgets where funds have been diverted for other purposes. Consequently, there may be significant differences between designs and final outputs.

Data and information supportive of adopting appropriate resilience standards are often missing, particularly robust financial risk metrics that enable the estimation of the probable loss the asset would experience over its design lifecycle along with the costs and effectiveness of different measures to strengthen resilience. Even in the case of infrastructure projects funded by multilateral development banks (MDBs), the application of design standards supported by robust risk metrics is still uncommon (World Bank, 2022). Few countries invest in the data and systems required to generate the risk information required (UNISDR, 2015).

Box 1.4

Box 1.4

Internalizing Risk in Infrastructure Assets

Disaster risk refers to the probability of disasters of a given intensity occurring in a given period of time. It is not an independent variable but is a function of three other variables: hazard, exposure, and vulnerability. Hazard refers to the probability and intensity of occurrence of a damaging event, such as an earthquake, tsunami, flood, or tropical cyclone, and is expressed in terms of frequency and severity. Exposure refers to the number, kinds, and value of assets located in areas exposed to the hazard. Vulnerability refers to the susceptibility of those assets to suffer loss or damage (United Nations, 2017).

Earthquakes and tropical cyclones are naturally occurring phenomena. However, the hazard posed by these events and the exposure and vulnerability of infrastructure assets are socially constructed (Wisner et al., 2003). The location of infrastructure (exposure) and how they are built (vulnerability) depend on planning and investment decisions which may internalize and accumulate risk in infrastructure assets.

Asset risk and resilience can only be measured in relation to hazard intensity and frequency and the exposure and vulnerability of assets. The internalization and accumulation of disaster and climate risk in infrastructure assets reflects, therefore, socially constructed drivers such as weak infrastructure governance, badly planned and managed urban development, environmental degradation, and climate change (UNISDR, 2009). Through the operation of such risk drivers, patterns of hazard, exposure and vulnerability are configured over time and disaster risk internalized and accumulated in infrastructure systems. As such, risk and resilience are endogenous rather than exogenous characteristics of infrastructure assets (UNISDR, 2015).

1.6. Service and Supply Chain Resilience

Indirect losses associated with service disruption are often greater than the value of asset loss and damage.

Providing services like water, sanitation, energy, transport, and telecommunications for households, businesses, and communities is the ultimate function of infrastructure assets, so ensuring the resilience of those services is as important as the assets. Service resilience refers to the capacity to buffer asset loss or damage in ways that allow continued service provision, rapid recovery, or adaptation or to be “safe to fail” (Ahern, 2011; Haraguchi & Kim, 2016; Kim et al., 2019).

Most service disruption is associated with asset damage or dysfunction. Sub-standard and poorly maintained infrastructure assets such as unreliable electricity grids, inadequate water and sanitation systems, and overstrained transport networks aggravated by disaster and climate risk leads to the disruption of essential services. The direct financial cost of disrupted infrastructure services on businesses and households in LMICs where data was available for gauging quantifiable impacts ranges from $391 billion to $647 billion per year along with unquantified impacts on well-being, health, productivity, and competitiveness (Hallegatte et al., 2019). Service resilience at local levels is, hence, critical to enhancing the capacity of communities and households to cope with and recover from different risks and shocks.

Indirect losses associated with service disruption are often greater than the value of asset loss and damage. A study of multiple post-disaster assessments (UN, 2015) indicated that the indirect economic losses associated with service disruption average roughly double the value of asset loss. Given a $301 – $329 billion AAL range in infrastructure sectors, the real cost of disrupted services could be as high as $700 billion per year without considering the broader impacts, as discussed above. As Box 1.5 describes, the implications of asset loss in critical infrastructure nodes such as ports are greater still.

Infrastructure systems characterized by variety and redundancy and with greater capacity to buffer losses, organically evolve, adjust and adapt to changing contexts are more resilient than rigid or brittle systems, that are dependent on single nodes or pathways for their functionality (da Silva et al., 2012).

For example, an agricultural area connected to urban markets through a variety of alternative transport routes would have greater redundancy and transport resilience compared to urban markets that are connected by a single bridge. Similarly, many Small Island Developing States (SIDS) depend on a single airport and port for the totality of their imports and exports, implying far lower redundancy or resilience than a larger country with multiple ports and airports. The ability of a hospital to divert its patients to other facilities and continue to provide services, for example, in the event of a collapse would imply greater redundancy or resilience than being dependent on a single facility.

Box 1.5

Box 1.5

Implications of Port and Maritime Disruptions on Global Supply Chains Source: Verschuur et al. (2022)

Ports are important for the local and regional economies, providing large employment opportunities, industrial clustering, and other value-added services. More importantly, they facilitate global trade flows by connecting supply chains across borders. But disasters affecting port areas leading to downtime can lead to large physical damages to port infrastructure, given the high density of valuable assets and revenue losses to terminal operators. Beyond these locally confined damages and losses, delays or disruptions of trade flows can affect domestic supply chains as well as supply chains in trade-dependent countries. Extreme winds associated with Typhoon Maemi (2003), for example, damaged multiple ship-to-shore cranes in the Port of Busan, disrupting exports for almost three months and affecting global supply chains dependent on South Korean products. Based on a detailed analysis of climate risks to port infrastructure and trade flows (Verschuur et al., 2022) and the dependencies between port-level trade flows and global supply chains (Verschuur et al., 2022), the exposure of global economic activity to climate-related disruptions can be quantified and compared to physical infrastructure damages. For instance, current physical asset damages were estimated at $6.5 billion per year. Downtime associated with operational disruptions and asset reconstruction can further lead to an additional $1.93 billion per year in revenue losses to port operators at 1,320 ports worldwide. More importantly, a total of $108.2 billion worth of maritime trade value is at risk every year. As every dollar of global maritime trade through ports contributes – directly or indirectly – $4.3 to the global economy (forward and backward supply-chain dependencies), disruptions could put economic activity worth over $400 billion at risk.

In relative terms, SIDS face the highest risk in terms of macroeconomic multipliers. Although physical damages are often relatively small, given ageing infrastructure and small port areas, ports in many SIDS supply goods that contribute to over 10 percent of domestic economies. As such, disruptions to these ports could diminish the economic growth potential of SIDS’ economies.

Small Island Developing States

(SIDS)

Redundancy levels are closely related to the density of infrastructure assets servicing a given territory or population. As discussed in Section 1.4., low-income countries have far lower redundancy and thus, service resilience based on their difference in the per capita value of infrastructure assets with high income countries. Service resilience is also conditioned by the treatment of interdependence in system design and operation, given that asset loss or damage in one system may generate non-linear service disruptions in other systems (Figure 1.7). As system complexity and interdependence increase, the channels through which direct impacts are translated into indirect impacts and their wider effects are increasingly characterized by nonlinearity and multiple feedback loops (Renn et al., 2020).

The economic impact of service disruption is aggravated by weak supply chain resilience. For example, the 2011 earthquake and tsunami in east Japan followed by the failure of the Fukushima nuclear power plant’s cooling systems led to the collapse of the electricity grid in east Japan after 11 nuclear reactors were taken offline, paralyzing the manufacture of critical components for automobile and information technology industries. Component shortages were then transmitted along global supply chains, slowing down or halting production altogether throughout Europe and North America (Maskrey et al., 2023; Todo et al., 2014).

Source: Chow & Hall (2023)

Service resilience, however, can be enhanced by effective early warning systems that can allow service providers to take account of an impending hazard and activate contingency arrangements that allow for the rapid service restoration. Cases where such an approach would be applicable would include the restoration of power following the loss of transmission infrastructure or the repair or replacement of bridges following floods.

Impact-based early warning systems can enable water and power utilities to take decisions regarding service resilience based on seasonal forecasts of expected rainfall, as Box 1.6 illustrates.

Box 1.6

Box 1.6

Impact-based Forecasts Strengthening the Resilience of Water and Power Sectors Source: UNESCAP (2018)

Impact-based early warning systems use hazard data and forecasts to assess their likely impact on various sectors (water, for example). Based on these forecasts, decision-makers can then rule on water storage and use in ways that minimize risk. In Sri Lanka, for example, forecasts for less-than-average annual rainfall between November 2017 and January 2018 allowed water management measures to take anticipatory measures that ensured provisions of 100 percent potable water requirement, 85 percent of irrigation water, and enough for the environment, wildlife, and inland agriculture across most districts. It also took a decision to boost thermal power generation in this period to compensate for declining hydropower. Impact-based forecasting, therefore, helps reduce service disruption and avoid negative impact on productivity and welfare.

As discussed above, climate change challenges service resilience even when infrastructure assets are not affected. For example, stormwater drainage provides the service of mitigating surface water flooding in urban areas. Due to climate change, even though the stormwater drainage assets are not damaged, more extreme rainfall events may increase service disruption. Similarly, extreme droughts do not damage water retention infrastructure such as reservoirs or bore wells but may disrupt the service provided, in this case, water supply. Importantly, water supply deficits affect marginalized groups of people more than others, as illustrated in Figure 1.9. Adopting policies and programmes that overcome and challenge issues of exclusion, vulnerability, and underrepresentation, therefore, will enhance resilience of the most marginalized.

1.7. Systemic Resilience

Systemic risks such as climate change and biodiversity loss, can be considered existential, given that they lead not only to escalating risks to infrastructure assets but threaten the habitability of the planet as a whole.

As such, the contemporary urban process, underpinned by a massive expansion in infrastructure investment, systemically generates risk. This systemic risk then feeds back into increasing infrastructure loss and damage. New investment that closes the infrastructure deficit but leads to increased systemic risk is ultimately self-defeating. Systemic resilience, therefore, is contingent on designing infrastructure investments in a way that does not generate new systemic risk.

Systemic risk is characterized by concatenated, non-linear, and cascading impacts. Cities such as Venice, Tokyo, Bangkok, and Jakarta, for example, sink due to a combination of uncontrolled groundwater extraction and rising sea levels (Hayashi et al., 2009; Phien-wej et al., 2006). Similarly, urban expansion and the replacement of green areas with asphalt, creates heat islands and increases the demand for energy for cooling, as well as carbon emissions. Finally, dispersed urban layouts, in contrast to concentrated layouts, make for highly inefficient land use but also magnify infrastructure costs by up to six times.

At the same time, asphalting formerly green areas increases peak run-off and flood hazard while additional distances for vehicles to travel multiply carbon emissions. A study that compared the implications for land use and infrastructure costs for dispersed and concentrated urban layouts in Puerto Rico found dispersed layouts required between 3 and 6 times more infrastructure assets for power, water, and wastewater services. Road length was 2.4 times longer, while twice as much land was required to accommodate the same area of private housing. (Caminos & Caminos, 1980).

Systemic risks such as catastrophic climate change and the collapse of biodiversity on a planetary scale are existential threats (Maskrey et al., 2023). As described in a recent IPCC report “[Climate change has caused] substantial damages and increasingly irreversible losses in terrestrial, freshwater and coastal, and open ocean marine ecosystems” (IPCC, 2021, p. 9). Approximately 3.3 to 3.6 billion people “live in contexts that are highly vulnerable to climate change”. Climate change is also “contributing to humanitarian crises” and “increasingly driving displacement in all regions, with small island states disproportionately affected”. Lastly, increasing weather and climate extreme events “have exposed millions of people to acute food insecurity and reduced water security”, with the most significant impact seen in parts of Africa, Asia, Central and South America, SIDS, and the Arctic.

Approximately 50 to 75 percent of the global population could be exposed to periods of “life-threatening climatic conditions” due to extreme heat and humidity by 2100. Climate change “will increasingly put pressure on food production and access, especially in vulnerable regions, undermining food security and nutrition” while extreme weather events “will significantly increase ill health and premature deaths from the near- to long-term”. If global warming passes 1.5°C, “human and natural systems will face additional severe risks” including some that are “irreversible” (IPCC, 2021). Figure 1.10 shows how extreme weather events grow in frequency and intensity with every degree increment.

Biodiversity is declining in parallel with anthropic climate change. Climate change aggravates biodiversity loss, together with urbanization, habitat loss, pollution, and others. Figure 1.11 highlights major declines in biodiversity across a wide range of indicators.

1.8. Fiscal Resilience

Presently, few low-income countries have the financial capacity to address infrastructure deficits; allocate sufficient budget to maintain existing infrastructure; and invest in the transition to net zero, strengthened assets, and service resilience. They also face difficulties in mobilizing significant private investment.

Domestic resource mobilization in LMICs, particularly low-income countries, is currently insufficient to address infrastructure deficits due to factors such as low national revenue, high debt repayments, weak growth, governance failures, and political crises. Over the past decade, infrastructure investment in low-income countries has followed a different path compared to other income geographies (Figure 1.12).

(expressed as a percentage of GDP) Source: World Bank (2023)

The COVID-19 pandemic further affected capacities for public capital investment. Despite the global economy rebounding in 2021, many LMICs and low-income countries are battling inflation, rising interest rates, and looming debt burdens. Competing priorities, low domestic resource mobilization, rising debt, an increasing cost of capital, and constrained fiscal space are further challenging increased public investment despite record levels of Official Development Assistance (ODA), a strong rebound in global Foreign Direct Investment (FDI), and remittance flows. Many LMICs now also face unsustainable levels of debt, undermining their ability to invest in resilience. Even before the COVID-19 pandemic, around half of low-income countries as categorized by the International Monetary Fund (IMF), and many emerging market economies were found to be either in debt distress or at a high risk (IMF, 2022). The pandemic has pushed debt levels to new heights as new spending needs were added while revenues were falling due to lower growth and trade, raising debt burdens of several LMICs and resulting in 60 percent of low-income countries at high risk of debt distress (Figure 1.13). In 2020 itself, the total external debt stocks of LMICs had risen by 5.3 percent to $8.7 trillion. Meanwhile, the total public and publicly guaranteed debt service to export ratio had risen from an average of 3.1 percent in 2011 to 8.8 percent among low-income countries.

(as of March 2022) Source: IMF (2022)

As far as private investment is concerned, the volume of capital raised by funds had quadrupled from about $34 billion in 2010 to $129 billion in 2021 (GIH, 2022). The longer-term story of private investment, however, depicts a widening gap between high-income and lower-income countries. Over the past decade, about three-quarters of private infrastructure investment in infrastructure has been concentrated in high-income countries, half of which has flown into renewable energy generation. LMICs only attracted a quarter of global private infrastructure investment mainly in non-renewable energy and transport sectors. In relative terms, investments in 2021 grew by 8.3 percent in high-income countries but fell by 8.8 percent across LMICs (Figure 1.14). Even among LMICs, however, most capital flows into middle-income countries. Low-income countries received only around 2 percent of global foreign direct investment in 2022 (UNCTAD, 2023).

Figure 1.14 Private Investment in Infrastructure in High-income versus Low- and Middle income Countries (2010-2021)

Source: Global Infrastructure Hub (2022)

Such a pattern is unsurprising given that private capital tends to flow into sectors and territories that offer the highest rates of return with lowest risk and the greatest potential for growth. Consequently, social infrastructure remains the smallest beneficiary of private investment growth in infrastructure (Figure 1.15). (Global Infrastructure Hub, 2021). This translates into a greater capacity to deploy capital in the short to medium term as new infrastructure investment opportunities arise, especially in a post pandemic era with rising interest rates.

Source: Averstad et al. (2023)

However, while the Global Infrastructure Facility, a G20 initiative, advocates for increasing gender-balanced and inclusive private investment in sustainable infrastructure to improve services and implementation of poverty reduction strategies enshrined in the SDGs across developing economies (G20, 2020), more private capital does not automatically translate into greater investments in LMICs. Apart from higher risks for investors, a shortage of bankable infrastructure projects is indicative of available capital greatly exceeding investment opportunities. Climate finance, totalling $632 billion in 2019 (Buchner et al., 2021), is another potential source of capital to close infrastructure deficits, strengthen asset and service resilience, and reduce systemic risk (Buchner et al., 2021). Over 90 percent of this funding was invested in climate mitigation, however, particularly in renewable energy, while adaptation finance (which can potentially be used to strengthen resilience) represented only 7 percent of the total funding. Moreover, almost all adaptation finance is public investment while mitigation finance is mostly covered by the private sector. As Box 1.7 highlights, even in countries like India, which are investing heavily in renewable energy, there is still a significant finance gap, in which the requirements are estimated to be three times greater than existing investment.

Box 1.7

Box 1.7

India’s Clean Energy Investments Source: (Birol & Kant, 2022)

India aims to meet 50 percent of its electricity requirements from renewable sources by 2030, equalling about 450 GW capacity, in its path to reach net-zero emissions by 2070. India has been consistently investing in renewable energy over the last decade and most significantly in the past few years; $8 billion in 2019, $6 billion in 2020, and $14.5 billion in 2022, recently pledging $4.3 billion more in the FY 2023-24 budget. These allocations are set to attract more private capital amounting between $80 and $125 billion by 2030. The International Energy Agency, however, estimates that India would need annual investments to the tune of $160 billion between now and 2030 to realize its goals.

Identifying a political and economic imperative to capture the resilience dividend is a critical challenge of our time. If that imperative is not recognized, decisions made now can lock cities, countries and the world into development trajectories that are neither sustainable or resilient. Investing in resilience today is critical to a sustainable future.

Infrastructure resilience is, therefore, a multifaceted challenge. First, high income countries need to invest massively to replace obsolete and decaying infrastructure to remain competitive and maintain public service provisions. Middle-income countries, secondly, need investments to enhance, modernize, and complete existing infrastructure and ensure full access to essential services for their societies. Third, low-income countries need investments in new strategic economic as well as local infrastructure systems to accelerate social and economic development and poverty reduction. Lastly and perhaps most importantly, countries across all income geographies need to transition towards net-zero economies while strengthening asset and service resilience.

Most high and some large middle income countries are already increasing their infrastructure investment levels. The USA, for example, allocated $550 billion in new spending via the Infrastructure Investment and Jobs Act of November 2021 to rebuild roads, bridges and rails, airports, provide high-speed internet access, and address climate concerns with spending spread over five years beginning in 2022. While India spent less than 0.4 percent of its GDP until 2014 on rail and road infrastructure, capital investments in this sector is expected to reach 1.6 percent of GDP in 2023, quadrupling over a 10-year period (Box 1.8). Similarly, it is estimated that China has invested $892 billion in its “One Belt One Road” initiative since 2013 to develop port, road, and rail infrastructure to integrate regional markets with its economy. In the coming years, it is expected that just four countries (China, India, Japan, and USA) will account for 50 percent of total global infrastructure investment and 80 percent within the G20 alone (Global Infrastructure Hub, 2021).

As has been highlighted, much of the infrastructure needed to support social and economic development is yet to be built in most LMICs (Thacker et al., 2019). In India, for example, capital investments of $840 billion are estimated to be required. Over half of this, about $450 billion, will be needed for basic municipal services, such as water supply, sewerage, municipal solid waste management, stormwater drainage, urban roads, and street lighting, to house the 40 percent of the country’s population that are expected to be living in cities by 2036 (Hallegatte et al., 2019).

Achieving the SDGs and net-zero economies in ways that also strengthen resilience for LMICs would require a significant increase in financial flows for infrastructure investments, India aims to meet 50 percent of its electricity requirements from renewable sources by 2030, equalling about 450 GW capacity, in its path to reach net-zero emissions by 2070. India has been consistently investing in renewable energy over the last decade and most significantly in the past few years; $8 billion in 2019, $6 billion in 2020, and $14.5 billion in 2022, recently pledging $4.3 billion more in the FY 2023-24 budget. These allocations are set to attract more private capital amounting between $80 and $125 billion by 2030. The International Energy Agency, however, estimates that India would need annual investments to the tune of $160 billion between now and 2030 to realize its goals. ↓ B O X 1 . 7 India’s Clean Energy Investments Source: (Birol & Kant, 2022) Confidential: Do no circulate 56 estimated at approximately $2.94 trillion per year (McKinsey Sustainability, 2022). Current levels of public investment and climate finance represent only a fraction of these estimates. While there is more than enough private capital available, very little currently flows to LMICs, particularly low-income countries.

In India, for example, central and state governments currently finance over 75 percent of urban infrastructure while just 5 percent are financed through the private sector (World Bank, 2023).

In such a context, an estimated total infrastructure AAL of over $500 billion across LMICs is unsustainable. Many countries can ill-afford to divert a substantial proportion of their capital to repair and rehabilitate disaster damaged infrastructure with their fiscal capacity further stressed if they are also left with a growing legacy of stranded assets amid an accelerated transition to net-zero. Many LMICs may be left behind as private investment flows into sectors such as renewable energy in high-income countries.

Nature-based Infrastructure Solutions

(NbIS)

Box 1.8

Box 1.8

India’s Eastern Dedicated Freight Corridor Source: World Bank Communication

India’s Eastern Dedicated Freight Corridor (EDFC) is a freight-only railway line financed by the World Bank through three investment loans totalling up to $1.7 billion in IBRD financing. The modal shift of cargo from road to rail would help the EDFC reduce greenhouse gas emissions on freight by nearly 50 percent by 2052 through electrification of rail lines and fuel consumption reduction. The Dedicated Freight Corridor Corporation of India Limited (DFCCIL), responsible for the EDFC, embeds the five pillars of resilience in railway design and operation, namely System Planning, Design and Engineering, Operations and Maintenance, Contingency Programming, and Institutional Capacity Coordination. DFCCIL identifies climate and disaster risks during planning by referring to a database of historical events/hazards. They include design features in bridges and embankments to address climate and disaster risks arising from floods, earthquakes, and other events. DFCCIL plans assets for collective redundancy, such as building connecting lines at locations vulnerable to floods, to support transport needs during an emergency. EDFC incorporates specific climate and disaster-resilient engineering measures during design and construction, such as resilient track design, mechanized track laying, and climate resilient signalling systems.

The economic case for investing in resilience is clear. First, strengthened asset resilience helps avoid asset loss and damage, reduce expenses for repair and rehabilitation over each asset’s design lifecycle, and reduces service disruption. Second, strengthened service resilience improves productivity and economic growth and enhances social development indicators through better quality health and education services. Third, strengthened systemic resilience contributes to enhanced biodiversity, cleaner water and air, reduced carbon emissions, and cooler cities, among other benefits. Lastly, strengthened fiscal resilience can contribute to more predictable and enhanced cash flow forecasts that can lead to higher asset values. Quantifying these economic benefits would help the outlines of a resilience dividend begin to take shape, where the full benefits of investing in resilience outweigh additional costs.

Capturing this resilience dividend, however, remains challenging. Weak infrastructure governance, a constrained fiscal capacity, and broader social and political challenges make it difficult to change trajectories across many LMICs. Resilience dividends may not be politically attractive even if they are identified as many of their benefits and co-benefits only materialize over long periods of time. Investing in resilience does not yet offer a compelling political or economic imperative for many governments or private investors.

Identifying a political and economic imperative to capture the resilience dividend is a critical challenge of our time. If such an imperative is not recognized, decisions could lock cities, countries, and the world into development trajectories that are neither sustainable nor resilient (Pols & Romijn, 2017; Seto et al., 2016; USFS, 2023). Investing in resilience today is, therefore, critical to a sustainable future.